How Go Zero Cracked 4 CR/mo on Quick Commerce

Remember when we thought two-day deliveries were peak convenience? Fast forward, and now we’re in the age of “blink-and-it’s-at-your-doorstep”. Quick commerce, that's right. Need milk for your coffee? Snacks for your Netflix binge? Or well, the latest iPhone in the market? It’s all just a tap away — and delivered before your 2-minute Maggi noodles are cooked.

India’s quick commerce scene is booming rapidly. From groceries to gadgets, this space is rewriting the rules of retail — and winning over people that value time and convenience over a little extra money.

And one such brand that has cracked Quick Commerce as a channel is Go Zero, a guilt free ice-cream brand. At GrowthX, we recently hosted Kiran, the founder of Go Zero for a fireside chat where he spoke at length about how they scaled on Quick Commerce and shared priceless insights on how you can do it too.

Here's a sneak-peak from the session👇

Before we get started, let me share some trivia on the brand

Kiran comes from a family that's been into the ice-cream business for ~50 years, with Apsara being his family business to now starting Go Zero independently.

And for Go Zero, Quick Commerce is a major channel for growth.

In fact, in just 26 months, they have scaled from 20 lakh/month run rate to a 4CR/month run rate in summer peaks on this channel.

Go Zero's journey through the years:

Phase 1: 2014-2018

At this point, quick commerce as a channel didn't exist and the likes of Swiggy & Zomato weren't as popular, they were still trying to find their footing and get traction. However, GT as a channel was big and brands like Apsara and Naturals had many offline parlours - making these two the major channel for Go Zero as well.

Phase 2: 2018-2021

Eventually, the food ordering channel started to expand. While pre-pandemic the split for offline to online was 70:30 or 75:25 - it grew massively during the pandemic. Since delivery was allowed during that phase, people started relying on it massively and a habit got formed which stuck by afterwards too. And so 50% of business for Go Zero started coming from Swiggy & Zomato and the rest from platforms like Food Panda, Magic Pin, etc.

Phase 3: 2022 - Present

This is where Quick Commerce came into the picture - get anything you want delivered to you in 10 minutes. While you imagine it to be limited to essentials, but it's come a long way. You get your food and beauty essentially to big ticket items like phones, playstations and more.

For Go Zero, they realised it was better to start a D2C Brand than go the parlour route owing to physical capital requirements. And so they decided to set up their dark stores instead. That meant saving operational costs by not having to be in prime locations. Having just a freezer and stock was enough to start an online business.

The real game changer for them was working with Quick Commerce platforms like Zepto. In the summer of 2024, they went all in with this channel. Although, the initial months were harder because they had to convince platforms as to why they should list Go Zero. This is easier to crack for bigger brands like Amul due to the initial pull, as the cost of storage is justified for the platforms, but for a newer brand like Go Zero, the lack of initial pull created challenges in convincing platforms on traction and marketing.

Through this case study, we'll have 4 solid outcomes:

First, what is quick commerce & how does it work?

10 minute deliveries have clearly become the norm and a standard expectation in our minds today and platforms like Blinkit, Instamart and Zepto are doing everything they can to make it happen and get the widest assortment possible. While it seems effortless to us, the real magic happens behind the scenes.

Let's break down the Quick Commerce Model:

It's a highly efficient system optimised for speed and is divided into 3 major steps:

1/ Stocking at Dark Stores

Quick commerce relies on dark stores — think of them like mini warehouses strategically placed in residential and commercial areas. Don't think of them as traditional warehouses or walk-in stores, they are designed purely for rapid order fulfillment and every square inch is optimised for efficiency.

To make "10 minute deliveries" a reality, it's important for them to get 3 things right with dark stores, i.e. the location, inventory and space design.

- Location: They are hyperlocal and essentially cover a small delivery radius of 2-5 kms. If that's not the case, instant deliveries will not be possible.

- Inventory: They stock the most in-demand items are stocked, based on customer data for that area. Their inventory for a residential area may differ from that of a commercial area. Platforms constantly evaluate sell-through rates, shelf stability, and customer feedback to decide which items stay and which go.

- Space Design: Quick Commerce platforms buy products directly from brands, store them in central warehouses, and replenish items in dark stores across cities and locations as per location consumption patterns. If these products are not sold from the dark stores or go bad because of a shorter shelf life, it leads to wastage of space for them - something they want to avoid. Hence, space optimisation is crucial.

I'll put this into perspective for you.

Imagine a dark store as a hyper-organized vending machine—but instead of dispensing candy bars, it stocks hundreds of fast-moving SKUs in limited space. Every item must justify its slot. If your product isn’t frequently selected, it risks being replaced by something that is.

Space optimisation is crucial for them and if your product struggles with sell-through rates or shelf stability, it risks being deprioritised or removed from the platform. Ensuring packaging, demand alignment, and shelf life are optimised is non-negotiable to maintain your spot.

2/ Tech-Driven Order Fulfillment

The moment you place an order, an advanced tech system kicks into action:

- The platform identifies the nearest dark store with the required item in stock.

- AI-powered tools assign a delivery partner and calculate the fastest delivery route.

- Staff at the dark store immediately pick and pack the order, ensuring it’s ready for pickup in minutes.

For you, this hyper-efficiency means your product needs to be easy to pick, pack, and transport without delays or complications.

3/ Last-Mile Delivery

The delivery partner ensures the item reaches you in record time. This happens via:

- A delivery partner gets assigned.

- GPS systems choose the fastest, traffic-free routes.

- Customers can track their order in real-time, adding trust and convenience.

Here, you need to solve for packaging and durability of your product. It needs to be able to withstand road bumps, weather conditions, and rough handling while still ensuring customer delight.

With an understanding of how the quick commerce model works, we will dive into how Go Zero leveraged this model and cracked it.

Second, How Go Zero entered Quick Commerce

and you can too.

Go Zero realised quick commerce was going to be a major channel for them. Now as we established, these platforms are picky about which brands they want to onboard with space optimisation being important for them - especially when it comes to temperature sensitive products because the overall handling cost is much higher becasue you need cold storage, high land and electrical requirements and skilled labour - adding to costs.

Despite all this and bigger players occupying major space, Go Zero carved a path for itself. They had their first conversation with Zepto and Blinkit back in December 2022 and the response wasn't very reassuring. Zepto, the more hungrier of the lot at the time being a new player eventually took a bet on them. And with time, they found their way into Blinkit and Instamart as well.

How did this happen? Well, there are 5 stages they went through from assessing readiness to finally listing.

Let's get into them one by one.

1/ Assessing Readiness

They started off by finding PMF with the channel, which came from getting high customer feedback and ensuring Word of Mouth for the product, ensuring willingness to pay since it was a slightly higher price point product and looking at retention (repeat purchases).

Here's how you can assess internal readiness before launching on Quick Commerce:

- Get your basics right Make sure your product’s shelf life, packaging, and pricing are sorted. Test these thoroughly to ensure they work seamlessly for quick commerce requirements.

- Collect consistent feedback

Get high customer feedback consistently. This will help you understand what's working and what's not and whether willingness to pay exists. - Look at existing success

If your brand is doing well in MT or GT, chances are you’re ready for quick commerce too. Why? Because you've find PMF there and it signals that your product is being liked and accepted by customers, and is likely to now do well on Qcomm as well.

Pro Tip:

If you're an F&B brand or dealing with perishable items, two aspects are absolutely non-negotiable: packaging and shelf life.

Let me explain.

1/ Nail Your Packaging

Your packaging isn’t just about aesthetics; it’s your product’s first line of defence while it deals with quick commerce logistics. Here’s what you need to keep in mind:

- Pre-Packaged Products

Platforms like Zepto and Blinkit favour pre-packaged goods because they are easy to handle, store, and deliver. - Durability

The delivery process can be bumpy — literally. Your packaging needs to withstand quick handling, bike rides, and temperature variations, especially if your product is sensitive (like ice cream). - Clear Labelling

Include essentials like expiration dates, storage instructions, and ingredients. This not only ensures compliance but builds customer trust.

Think of packaging as your silent salesperson — it conveys your product’s value before the customer even tries it.

2/ Solve for Longer Shelf Life

Quick commerce platforms value operational efficiency, and a product with a short shelf life disrupts that. Here’s what you need to aim for:

- Minimum Shelf LifeYour product needs to stay fresh for at least 3-6 months. This helps platforms avoid wasted inventory and keeps stock moving smoothly. Remember, space optimisation is of prime importance for them. If your shelf life is, let's say 10 days, the time for it to take off from the shelf will be super low before it starts going bad, leading to wastage for the platforms. That's not a place they want to be in and so it becomes super important for you to solve for it.

For example, Go Zero’s ice creams are a high-touch category requiring constant cold storage. By ensuring that their products had optimal shelf stability and well-thought-out packaging, they minimised handling complexities for platforms while maintaining product integrity.

2/ Finding your foot in the door

Now that you know you're ready to launch on Quick Commerce, you probably start figuring out how many SKUs to list, which ones to prioritise and try finding connects with category managers across different platforms.

This is not easy. But there's a process to it that will help you get there. Let's see how Go Zero found it's footing with quick commerce.

They did 3 major things here:

- Reached out and connected with relevant folks

- Identified and prioritised top 2 or 3 SKUs to launch with

- And, co-created SKUs with Category Managers.

Let's look at it one by one.

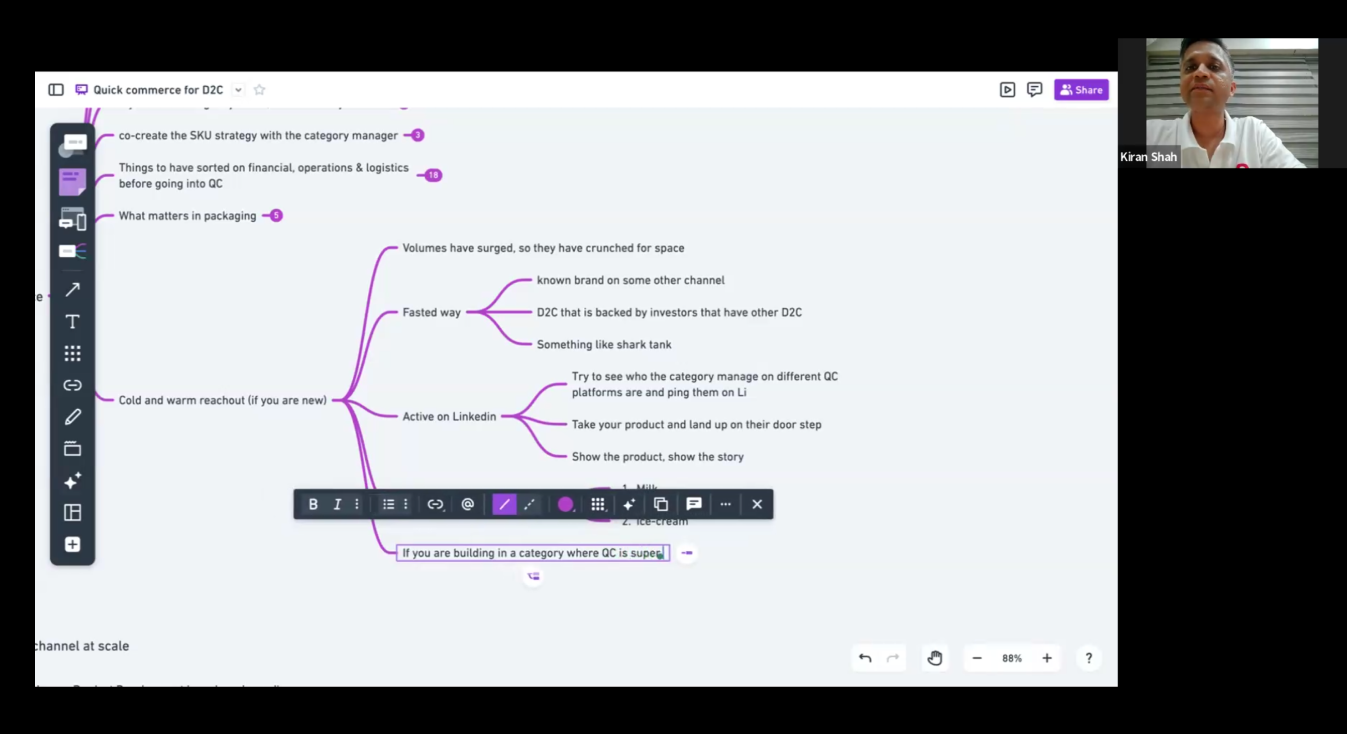

I. Reaching out and finding connects:

The waitlists for Quick Commerce platforms are on a rapid rise. If you're a new brand, it's hard to get through because volumes have surged and platforms are crunched for space. This is because there's not enough infra with limited dark stores available and more and more brands are coming up to list on the platforms. So unless they have more space and move to bigger/more dark stores, they're going to be super selective with brands they onboard.

You want to become a brand that they want to onboard, despite being selective. But how do you get there?

One way it to definitely find the right connects. Let's see how:

If you tick off even one of these 3 things, it will help you find a way in quickly:

- If you're a well established brand in other channels like MT or GT.

- If you're a D2C brand backed by VCs or investors.

- You've appeared something like a Shark Tank and they know there will be demand.

But hey, you might be a new brand that's looking to launch via Quick Commerce or isn't financially backed yet - does that mean finding connects is impossible? No. It's slightly harder but you can find your way in if you're creative enough.

Here are some ways to help you:

- As these orgs are becoming more active on LinkedIn, keep an eye out for who your category managers and ping them.

- Probably even take your samples to their doorstep, make them try the product and tell your story.

Did you know?

The most searched keyword on quick commerce is "Milk". The second in line is "Ice Creams".

So, if you're building in a category like this or one where QC is a hot channel for consumers, go all out. You should pester your category managers. Reach their doorstep, show them the product, make them try it, give them offers. Do everything you can.

II. Prioritising SKUs for launch

Now that you've found the right connect, you want to figure which SKUs to go live with. With limited space in dark stores and the high stakes of customer expectations, you want to be careful with your pick. This feels tricky, right?

There are two ways to look at it.

If you're doing well on MT or GT

Here you have an advantage - data. Leverage it.

Look at sales data from your existing channels and pick the top 2 or 3 SKUs that consistently drive the most volume or revenue. Why?

- They're already popular with customers.

- They are aligned with quick commerce principles of being fast-moving and high-demand.

- Platforms trust already proven products - since they've worked in MT/GT, they're likely to work here.

- Customers are likely to recognise and purchase familiar SKUs, reducing the friction to try new stuff.

Example: If your 500ml Vanilla Ice Cream and 1L Chocolate Ice Cream tubs are your best sellers in MT, these are natural candidates to launch on quick commerce platforms.

If you're starting out on Quick Commerce

When you don’t have prior sales data, the approach shifts. You need to depend on external signals here.

- Study Competitor Data

Research which products are driving sales for competitors in your category. This could involve browsing the quick commerce platform or studying market reports. - Look for Trends

Are specific flavours, formats, or price points dominating? For example, in the ice cream category, classic flavours like Chocolate and Vanilla may be consistently popular. - Start Small, Iterate Quickly

Instead of launching a wide range, go live with 2-3 SKUs that align with observed trends. Track their performance over the first few weeks and adjust based on sales data.

III. Co-creating SKUs with Category Managers:

At Go Zero, they co-create SKU strategy with category managers. They constantly speak to their category managers to figure whitespaces that exist and if there's something they can build together.

Co-creating SKUs with category managers can be a game-changing strategy for brands looking to break into or scale on quick commerce platforms. Three reasons why this works:

- You get access to massive customer data and insights to identify opportunities.

- By launching exclusive SKUs, you give platforms an edge over their competitors, making them more willing to prioritise your product.

- Collaboration results in vested interest by both parties, leading to better visibility and support.

How Go Zero Does It

Go Zero’s category manager at Zepto approached them with a challenge:

- The Problem

The platform was oversaturated with chocolate ice creams (10+ brands already offering it). While it was a consumer favourite, Zepto wasn’t looking to add another SKU that blended into the crowd. - The Solution

Zepto identified a whitespace in their assortment—a lack of premium, experimental flavours like Tiramisu. They suggested Go Zero develop a Tiramisu ice cream to stand out. - The Process

- Go Zero evaluated the idea against their team’s skills and production capabilities.

- They created samples and shared them with Zepto for feedback.

- After fine-tuning, the product went live as an exclusive offering, creating a win-win for both parties.

How can you co-create SKUs for your brands?

First things first, this may not apply to your product, but if it does, it can be a great win-win situation. Let's see how you can do this.

Build Relationships with Category Managers

- Treat category managers as strategic partners. Regularly engage with them to understand their goals and pain points.

- Position yourself as a problem-solver willing to collaborate.

Leverage Platform Data

- Ask for insights on customer behaviour, sales trends, and gaps in the current assortment. They have a crazy amount of data and insights, leverage them.

Evaluate Whitespace Opportunities

- Before jumping into co-creation, assess whether the opportunity aligns with your brand’s strengths and production capabilities.

- Be transparent about timelines, feasibility, and any challenges during discussions.

Prototype and Iterate Quickly

- Once an idea is agreed upon, move fast. Share samples, incorporate feedback, and refine until the platform is satisfied. Agility is key.

The Bottom Line

Just like you, platforms are also constantly chasing differentiation to be one step ahead of their competitors and stand out. Hence, building exclusive SKUs with them helps them have a unique assortment and acquire more customers as well. Identifying whitespaces together based on customer data and solving for it via collaboration sometimes ends up becoming a great way to find your foot in the door!

With that, you've now probably found your foot in the door by reaching out to the right people, building relations, figuring out the SKUs to launch and perhaps co-creating some of them. Next, you need to solve for finance, operations and logistics.

3/ Sorting finance, operations and logistics

Quick commerce is fundamentally an operational and supply chain game. To do well, you need to optimise your finance, operations and logistics and nail this. Let's see how.

Navigating Purchase Orders and Supply Chain Timing

In quick commerce, the pace is unforgiving. Let's see how it works:

- Every week or bi-weekly, a purchase order (PO) is generated by the demand planning team based on dark store requirements.

- Initially, POs will be smaller, and transport costs will be higher, which may tempt you to wait and batch multiple POs together. However, this can backfire. Quick commerce thrives on speed and availability. If you miss the mid-mile warehouse to dark store replenishment cycle, customers will simply switch to a competitor. You need to take the initial hit on transport costs to ensure availability and fill rates.

Remember: Fill-rate is an extremely important criteria here and your product needs to be available when the requirement arises

Having a 3 prompt strategy to solve for this:

- Expand your footprint

Try to get into as many cities as you can. It's hard but keep trying and and aim to enter major cities like Mumbai, Delhi, Bangalore. - PnL Management

- In your P&L, understand that your logistics cost will initially be higher than the BAU logistics cost.

- Let's say you're working at a 5% margin with other channels. Be flexible with quick commerce and be ready to operate at an 8-10% margin for the first couple of months. It’s important to accept this hit rather than wait for batching to happen, as speed and availability are key for success.

- Negotiating with Category Managers

- When launching a new brand, you’ll likely need to offer discounts, spend on banners, and run performance marketing campaigns. This is where you need to fight tooth and nail and negotiate the best offers with your category managers. Look at 2 major things here:

- How much marketing budget you’ll contribute versus how much the platform will provide. Let's say your marketing spends are 20 lakhs. You negotiate terms where you get 20 lakhs as the budget but you only pay 15 lakhs while the platform gives you the remaining 5L.

- Discount distribution, example, if you're offering a 25% discount, you may contribute 20% and the platform foots the remaining 5%.

- When launching a new brand, you’ll likely need to offer discounts, spend on banners, and run performance marketing campaigns. This is where you need to fight tooth and nail and negotiate the best offers with your category managers. Look at 2 major things here:

4/ Packaging in Quick Commerce

As a founder, your intent should be for consumers to receive the best product in the best possible packaging, irrespective of the channel. While in traditional models, customers can touch and feel your product to build trust, you don't have that option with Quick Commerce. Consumers make a decision based on what they see on the app. That’s where your visual identity plays a crucial role.

To truly stand out, focus on two essentials:

- Cataloguing and High-Quality Imagery

Your product photos should be sharp, clean, and visually appealing. Highlight key details, such as texture, size, or unique features. This makes the product feel tangible to the consumer. - Video Thumbnails

Thumbnails that include short, engaging product videos are like mini ads—they capture attention, showcase your product in action, and leave a stronger impression. Think of them as an opportunity to visually immerse and excite the consumer.

5/ Understanding Platforms: Swiggy v/s Blinkit v/s Zepto

When it comes to Quick Commerce, about 80% of the product assortment across platforms overlaps, with the remaining 20% being their play on differentiation. This differentiation often comes through unique partnerships—for example, Hamleys being listed on Instamart.

For platforms, it’s not just about selling essentials; it’s also about customer acquisition. To stand out, they actively seek brands that bring something unique to the table. If you co-create SKUs with them by addressing untapped gaps in their assortment, it’s a win-win. However, this comes with its challenges, like managing lower MOQs since these SKUs may not work across other channels. That said, it’s a shot worth taking.

Key Differentiators for these platforms:

Basis | Blinkit | Instamart | Zepto |

|---|---|---|---|

Regional Strengths | Stronger in the North as a function of Zomato having its footing there. Plus more riders present on ground. | Similar to Blinkit, Instamart is stronger in the South owing to Swiggy's deeper footprint in that region. | Zepto is a pureplay Quick Commerce brand headquarted in Mumbai, making it stronger in that region. |

Super App Synergies | Zomato has dedicated apps for food, quick comm (blinkit) and events - creating a more siloed approach. | Swiggy's super app ecosystem brings together Food delivery, Instamart and Dineout - all in one app, making user experience seamless | Pureplay qcomm app. |

Discount Sensitivity | More mature audience prioritising convenience and product quality over discounts. | More mature audience prioritising convenience and product quality over discounts. | Attracts the most discount sensitive audience. |

Let's quickly summarise:

Third, How do you succeed on Quick Commerce

How Go Zero solved for Marketing and Growth.

You've found your foot in the door, gotten yourself listed and solved for packaging. Now comes the time to solve for visibility and discoverability to succeed on the platform. This comes by having a solid marketing plan in place. Let's get into it.

There are primarily two types of marketing assets.

- Search includes your bids on relevant keywords that align with user intent.

- Merch includes homepage banners, push notifications, and WhatsApp campaigns.

If you're on a limited budget, say 8-10 Lakhs or lower, here's how you should approach it:

- Avoid spreading yourself too thin on a lot of assets, something even platforms discourage.

- Do not expect any Free of Charge for the first 4 weeks to 3 months. Once your budget increases and you're more established, the platform will also start contributing to your marketing spends. For example, your total marketing budget is 20 lakhs out of which you foot 15L and they foot 5L. However, do not have this expectation early on with a smaller budget.

- Go all in with search and have a performance marketing manager to help you navigate.

Go Zero's Approach:

For ice cream, the intent to buy exists around/after meal times [dinner, midnight, lunch]. And so they highly focus on their campaigns during these peaks.

Why?

Because if ads are live at all times, there is heavy competition from other brands like HUL, Kwality Walls etc who are also bidding for similar keywords. That leads to the budget being spent quickly but not many sales/conversions.

What works?

Starting and stopping campaigns at specific times - in their case meal time slots.

Interesting observation about meal times and ice cream consumption:

Meal time slots:

- Breakfast: 7 am to 11 am

- Lunch: 11 am to 3 pm

- Snacks: 3 pm to 7 pm

- Dinner: 7 pm to 11 pm

- And finally, post dinner consumption happens from 11 pm until the dark store shuts.

Interestingly, 20-25% of Go Zero's consumption comes from the late night slots!

For them, it makes sense to allocate majority of the budget to the slots where demand and consumption is higher, which is post meal times - especially late nights. Otherwise, most of the budget will get spent on gathering impressions through the day and during slots where there's intent, it will run out.

For your use case:

Understand user behaviour and figure out what time slots are your users most active in and what is it that they search for the most (try looking at specific keywords as compared to broad ones).

Bid on these keywords, particularly at specific precise time slots where the intent is high. This is because you'll face competition from bigger brands throughout the day and if the targeting is not done right, you will end up exhausting your budgets in just garnering impressions and not get as many sales and conversions.

And finally, scaling on Quick Commerce

While finding a foot in the door and entering quick commerce is hard, the real challenge lies in scaling this channel. Because if you're not able to scale and meet the minimum run-rate constantly, chances are you will get de-listed from the platforms with space being a super important aspect for them.

Hence, this is extremely crucial to crack and will need you to go all in. For that, you will need to spend on your marketing and inventory.

3 Fundamental principles on how to scale:

Let's get into it.

One, Have a very effective search plan

- Look at keyword data, study your competitor's efforts very closely.

- At Go Zero, they have a dedicated person to study their competitor's search efforts. Look for what ads they're running, offers, discounts, SKU's, areas they're selling in and more.

Two, run many different campaigns

- At Go Zero, they're running approx 95 different campaigns.

- Example: 1 campaign for 1 SKU in Hyderabad [basically SKU and city specific]

- They also run ads for ice cream as a broad keyword but with a very limited budget for a small window

Three, get access to dark store level data

- The job doesn't end at delivering the stock. You need to be aware of whether or not its being sent to the dark stores, the inventory levels, SKUs, whether it has gone out of stock and more.

- You need to be on the top of your category manager's head and ensure TOMA - super helpful.

- For Go Zero, they use tools like Gobblecube to get access real-time data via dashboards on inventory level in specific cities. You can also develop in house scripts or use APIs for the same.

- Once you have this data, take it to your category managers and have a conversation on "this SKU is getting traction, it's getting out of stock, let's bump it now"

- When they didn't have the budget for tools - they had a person manually checking every pincode for all SKUs - something you can do if your presence and SKUs are limited at the time.

With that, we’ve completed this case study on cracking quick commerce. We looked at how Go Zero found it's footing in Quick Commerce and scaled over the years and also how you can apply this to your brand and crack Quick Commerce as a channel.

If you want to learn more about Go Zero and their Growth Strategy, here's a video for you:

I'll see you in the next one.

Till then, happy learning 💙

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.